Homeowners will bear the brunt of responsibility in shoring up the financial gaps for State Farm General after the California insurance commissioner sided with an administrative law judge ruling to allow an emergency 17 percent rate increase.

That’s off from the original request by California’s largest insurer to hike homeowner rates by 21.8 percent following January’s Palisades and Eaton fires. State Farm was temporarily granted the emergency rate increase for California in March, which also included a 15 percent jump for renters and those in condominiums and a 38 percent uptick for landlords.

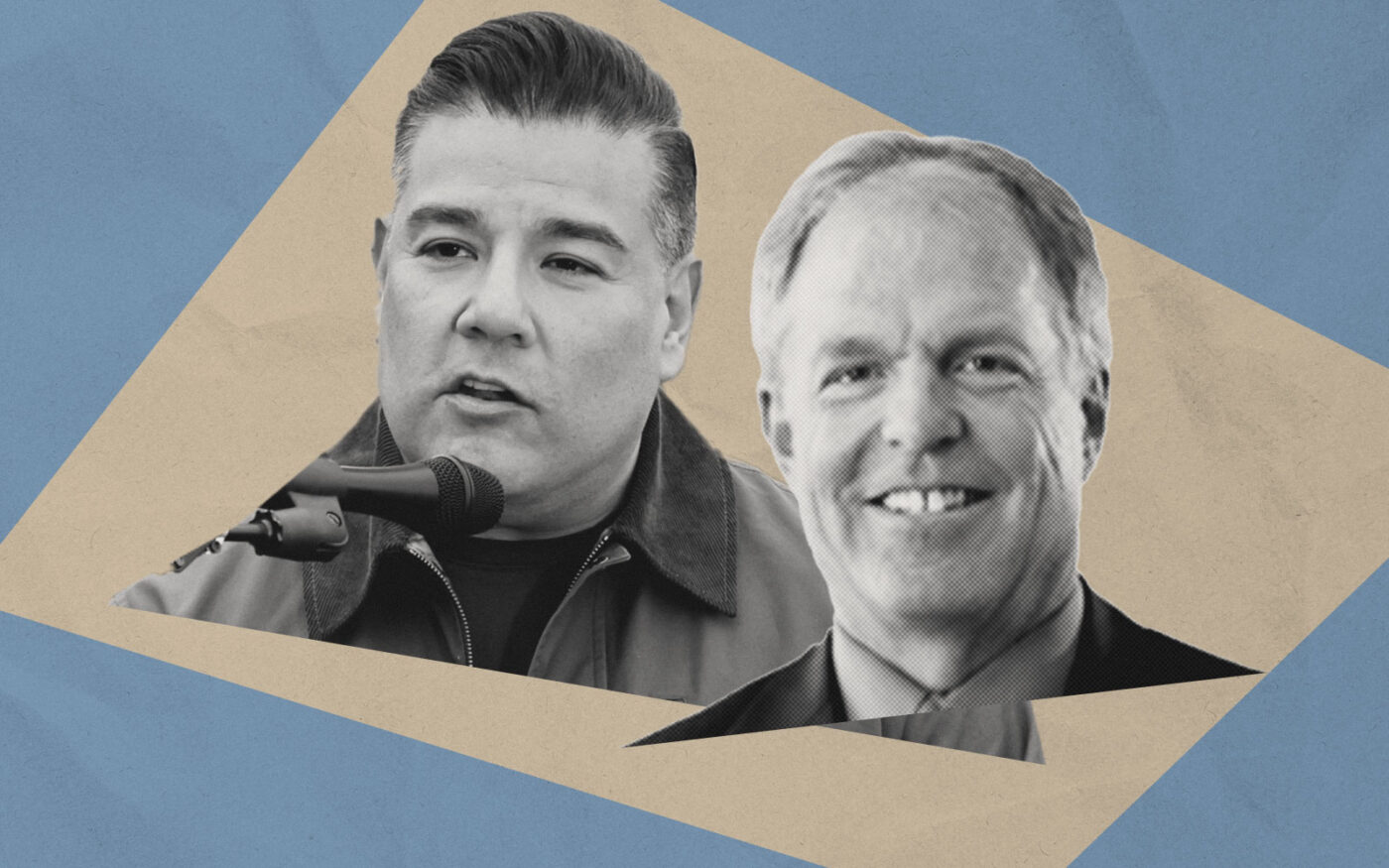

California Insurance Commissioner Ricardo Lara said in a statement Tuesday he factored in fairness for consumers with State Farm’s dire situation in describing what he called a “statewide insurance crisis.”

That’s roughly in line with the judge’s ruling, which pointed out the 17 percent increase shifts “a significant portion of the financial burden onto policyholders,” but is the “only practical means of stabilization” for State Farm’s business.

S&P Global lowered its rating on State Farm General the same day of Lara’s decision from AA to A+, citing “underperformance and declining capital.” The ratings agency also said it was factoring into its decision the regulatory red tape around rate hikes in the state.

For State Farm’s part, its Illinois-based parent, State Farm Mutual Automobile Insurance Company, must kick over $400 million to act as an immediate liquidity cushion. State Farm will also agree to stop non-renewals on residential policies.

The insurance company also clarified that State Farm General would repay the $400 million note, plus interest, “because customers outside California should not be expected to pay for risks in California.”

State Farm called Lara’s approval a “critical first step” in its ability to continue to do business in California in a statement.

The approval — which would take effect in June for the more than 1 million homeowners State Farm insures in the state — is on an interim basis and will ultimately be reviewed again in a full hearing.

“State Farm must now justify its financial condition and detail its recovery plan in a full-rate hearing before a neutral judge and my department’s experts,” Lara said in his statement. “I am focused on ensuring that State Farm pays its claims to wildfire survivors fully and fairly — and nothing is off the table.”The sentiment echoes what Lara reportedly told a crowd of wildfire victims over the weekend, when the Los Angeles Times said Lara indicated a probe into State Farm’s practices was being considered amid mounting complaints from policyholders.

Read more