Americans are buying fewer second homes, a new report found.

Last year, Americans took out about 86,600 mortgages for second properties. This represents a six-year low, according to listings platform Redfin.

However, while 2024 marked a new recent low for these deals, the rate of decline is improving, per Redfin. Last year, the number of second-home mortgages fell 5 percent year over year, and they fell 40 percent from 2022 to 2023. Meanwhile, from 2021 to 2022, they dropped 42 percent.

Second-home mortgages are also taking up a smaller share of all mortgages. Last year they made up just 2.6 percent of mortgages, which is the lowest share in Redfin’s accounting and is 2.8 percent lower from 2023.

The most recent high for second-home mortgages was in 2021, when more than 258,200 were taken out. This followed increases since 2018. Redfin attributed this boost to the pandemic, when wealthier home buyers who were able to work remotely tapped into low interest rates to pick up another property in which to ride out the pandemic.

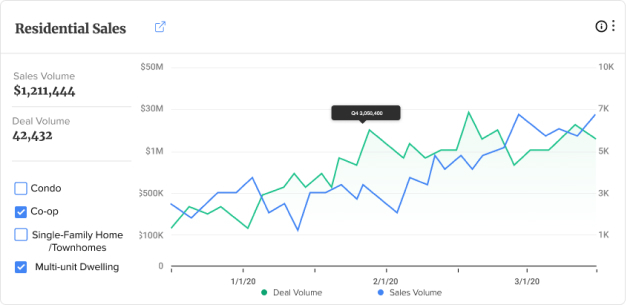

Subscribe to TRD Data to see this content!

Among the most populous metropolitan areas, most of the second-home mortgages originated in Phoenix, followed by Riverside, California. However, Detroit and San Francisco saw the greatest growth in originations – 26 percent and 17 percent, respectively – year over year. Miami and Orlando saw the biggest drops from 2023, of 32.2 percent and 28.4 percent, respectively.

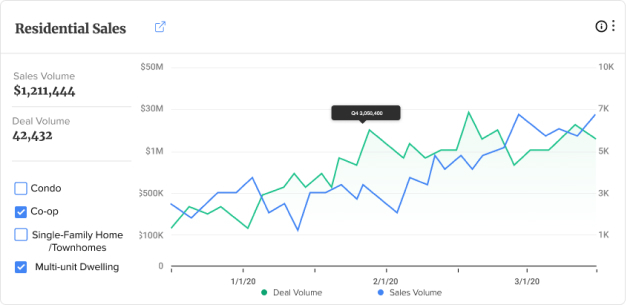

Subscribe to TRD Data to see this content!